[LS7] - Islamic Finance in Energy Transition | Transition Finance Assessments in Indonesia, Thailand, and Malaysia

28 July 2025

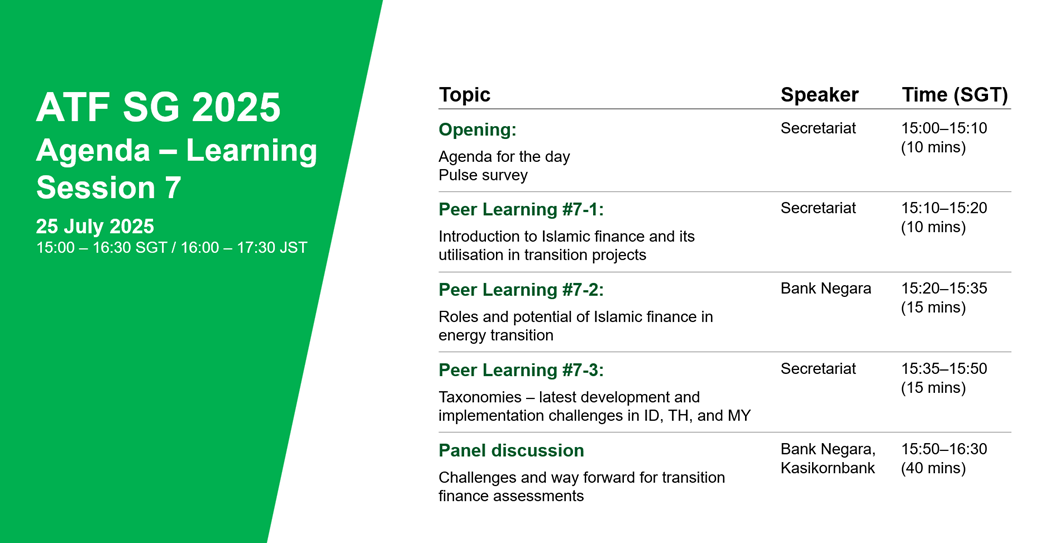

The Asia Transition Finance Study Group (ATF SG) held the seventh learning session (LS7) of 2025 on 25 July (Fri).

The ATF SG hosted the seventh learning session for 2025 on 25 July via Zoom, exploring the role of Islamic finance in supporting the energy transition and examining the challenges associated with transition finance assessments in ASEAN.

The Secretariat introduced Islamic finance as an emerging driver of the energy transition in Indonesia and Malaysia, highlighting its alignment with green finance through shared principles, such as prioritising social welfare, sustainability, and responsible resource use. Indonesia has a growing sovereign green sukuk market, while Malaysia is seeing increased private-sector interest in Sustainable and Responsible Investment (SRI) sukuk. Bank Negara Malaysia (BNM), a guest speaker in LS7, further elaborated on the potential of Islamic finance in supporting the energy transition, noting its shared underlying principles with green finance, such as avoiding harm and ensuring financial activities are backed by real economic value. BNM also mentioned that Islamic finance is built upon strong market foundations, making it well-positioned to support broader sustainability agendas, including financing transition projects.

The Secretariat also presented an overview of recent taxonomy developments in ASEAN, with a brief comparison of emission thresholds and technical screening criteria to highlight limited interoperability due to differences across jurisdictions. Additional challenges identified included misalignment with national targets, inconsistent interpretation among stakeholders, varying national contexts, and limited access to quality data. To support financial institutions in navigating these issues, the Secretariat introduced a set of guiding questions, alongside the updated ATF guideline, to help institutions determine and refine their own approaches to transition finance suitability assessments.

The session concluded with a panel discussion featuring representatives from BNM, Kasikornbank, and Mizuho Bank. Panellists discussed persistent challenges in conducting transition finance assessments, shared perspectives on the growing momentum behind taxonomy adoption at both national and regional levels, and reflected on short- and medium-term priorities for unlocking and scaling transition finance.